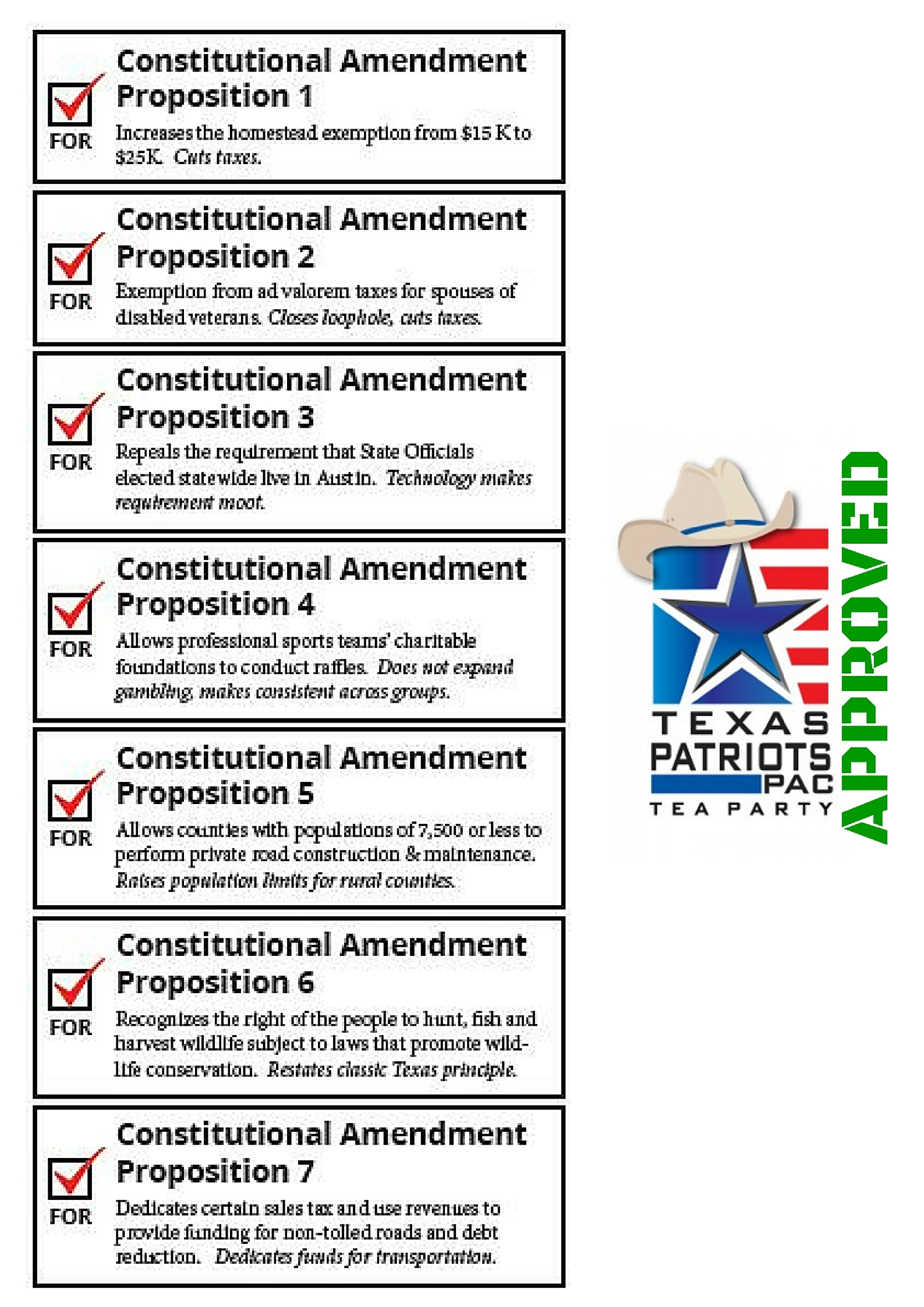

Texas Constitutional Amendments

Texas Patriots PAC recommends voting FOR all of these amendments

Proposition 1 – SJR 1

Text: “The constitutional amendment increasing the amount of the residence homestead exemption from ad valorem taxation for public school purposes from $15,000 to $25,000, providing for a reduction of the limitation on the total amount of ad valorem taxes that may be imposed for those purposes on the homestead of an elderly or disabled person to reflect the increased exemption amount, authorizing the legislature to prohibit a political subdivision that has adopted an optional residence homestead exemption from ad valorem taxation from reducing the amount of or repealing the exemption, and prohibiting the enactment of a law that imposes a transfer tax on a transaction that conveys fee simple title to real property.”

Why we support this: Property taxes in Texas are too high, especially for elderly folks on fixed incomes, some of whom are being taxed out of their homes. This amendment would require school districts to increase the homestead exemption from $15,000 to $25,000, giving much needed relief to these homeowners. This is a step in the right direction as it regards property taxes.

In short: Cuts taxes

Proposition 2 – HJR 75

Text: “The constitutional amendment authorizing the legislature to provide for an exemption from ad valorem taxation for all or part of the market value of the residence homestead of the surviving spouse of a 100 percent or totally disabled veteran who died before the law authorizing a residence homestead exemption for such a veteran took effect.”

Why we support this: Currently, surviving spouses of 100 percent or totally disabled veterans who died after January 1, 2010 are eligible for this property tax exemption. This amendment clarifies a loophole in the law which was passed in 2009 to make the exemption available to surviving spouses of 100 percent or totally disabled veterans who died before the law was passed. This is a step in the right direction as it regards property taxes, and will provide relief for spouses of veterans who served our country.

In short: Closes loophole, cuts taxes.

Proposition 3 – SJR 52

Text: “The constitutional amendment repealing the requirement that state officers elected by voters statewide reside in the state capital.”

Why we support this: This repeals the requirement passed in 1876 that statewide elected officials reside in Austin. This requirement was meant for the horse-and-buggy days, in order to ensure that elected officials were in Austin doing the jobs they were elected to do. However, technological advances in communication and transportation now make this requirement unnecessary. The requirement can already be skirted if public officials simply buy an apartment in the Austin city limits and declare this as their primary address. If elected officials are not doing their jobs, it is up to the voters to decide this come election time.

In short: Technology makes the point of this requirement moot.

Proposition 4 – HJR 73

Text: “The Constitutional amendment authorizing the legislature to permit professional sports team charitable foundations to conduct charitable raffles.”

Why we support this: The Texas Constitution has been amended various times over the years in relation to the state’s current prohibition policy toward gambling in order for charitable foundations to be able to conduct raffles as long as the proceeds are used for charitable purposes. Current exemptions to the policy include religious societies, volunteer fire departments, volunteer emergency medical services, and nonprofit organizations. This amendment would extend that right to the official charitable organizations of sports teams.

In short: Does not expand gambling, makes consistent across groups.

Proposition 5 – SJR 17

Text: “The constitutional amendment to authorize counties with a population of 7,500 or less to perform private road construction and maintenance.”

Why we support this: Currently, if a county has less than 5,000 residents, the county may be employed to perform private road construction and maintenance as long as the county imposes a reasonable charge for their work. This is because many rural counties with low populations do not have contractors available to hire for road construction and maintenance. Therefore, this amendment does not entail allowing the government to compete against private enterprise, as in these rural counties, there is no private enterprise with which to compete. This amendment would raise the cap to 7,500 residents, as many counties that were previously under the 5,000 resident cap suddenly found themselves above the cap with the simple addition of a prison.

In short: Raises population limits for counties to allow residents to contract with the county for construction and maintenance projects.

Proposition 6 – SJR 22

Text: “The constitutional amendment recognizing the right of the people to hunt, fish, and harvest wildlife subject to laws that promote wildlife conservation.”

Why we support this: This amendment enshrines in our constitution the right to hunt, fish, and harvest wildlife subject to laws. Currently, the Texas Constitution does not declare hunting and fishing to be a right of the people, but only allows the legislature to pass preservation laws. This amendment does not alter the regulation scheme, but simply adds constitutional protection for the tradition, while also establishing hunting and fishing as the preferred methods of conservation in managing and controlling wildlife. The amendment is similar to amendments passed in 18 other states in order to protect the long-standing traditions of hunting and fishing against efforts to curb them.

In short: Restates a classic Texas principle.

Proposition 7 – SJR 5

Text: “The constitutional amendment dedicating certain sales and use tax revenue and motor vehicle sales, us, and rental tax revenue to the state highway fund to provide funding for nontolled roads and the reduction of certain transportation-related debt.”

Why we support this: Over the past several decades the Texas legislature has made it a practice to gradually decrease the amount of money they dedicate toward transportation, choosing to spend money first on non-essential items and programs in order to use the importance of funding transportation as an excuse to raid the rainy day fund after all the money has been spent. In an ideal world, the legislature would practice fiscal responsibility and fund priorities, like transportation, first before considering other items. However, we cannot continue to rely on the legislature to act so responsibly. This amendment would constitutionally lock down a funding stream for transportation that the legislature could not raid. Additionally, this funding cannot be used to build toll roads, which are increasingly springing up across Texas and constitute double-taxation.

In short: Dedicates funds for transportation